24

With its sophisticated and technologically advanced

range of engines, DS is well placed to reconcile

performance with low taxation levels and reduced

environmental impact.

This means that when choosing a DS vehicle, you’re

assured access to superb and guilt-free motoring

combined with the quality and luxury that DS offers.

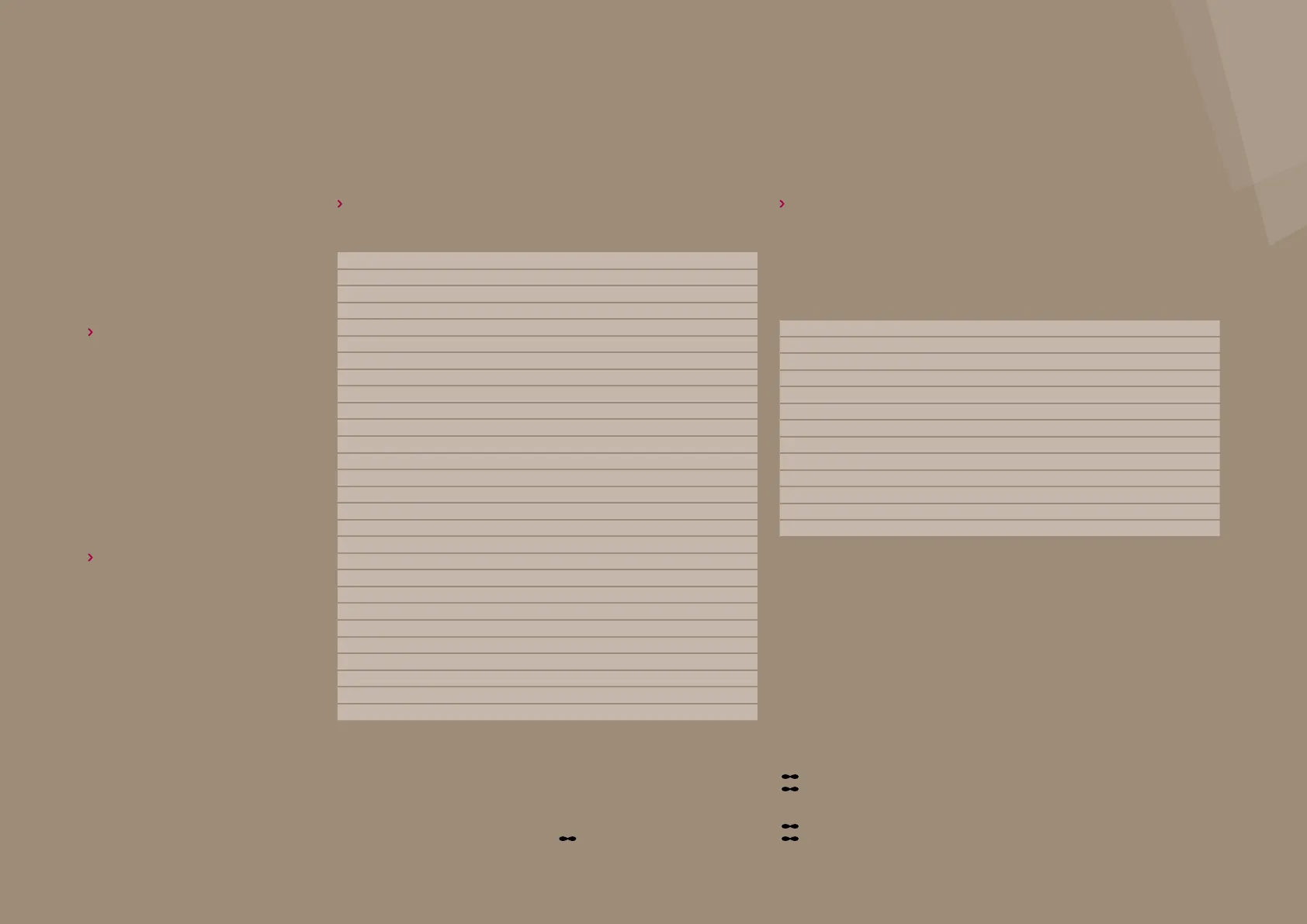

COMPANY CAR BENEFIT-IN-KIND

TAXATION CHARGES

The Company Car Benet-In-Kind Taxation charge

is based upon the type of fuel used, and the level of

CO

2

emissions, measured in grams per kilometre

(g/km). The table opposite shows the percentage of

the car’s list price to be taxed (P11D value

†

).

For example, a DS 4 DStyle Nav BlueHDi 120 S&S

6-speed manual has a CO

2

emissions gure of

103g/km and the P11D gure of £22,440

The BIK value would therefore be 16% x £22,440 =

£3,590.40 (equivalent to £59.84 pcm for a 20%

rate tax payer).

FUEL SCALE BENEFIT CHARGE

The taxable value of free fuel provided for private

usage is linked to CO

2

emissions. The taxable benet

will be assessed using the same scale as for BIK,

and the percentage applied against a set gure. For

the tax year 2014/15 onwards this gure is set at

£21,700

For example the Free Fuel benet for a DS 4 BlueHDi

150 S&S 6-speed manual DSport would be 16% x

£21,700 = £3,472 An individual driver would pay

tax on these gures at their marginal tax rate.

An individual driver would pay tax on these gures at

their marginal tax rate. More information about the

Company Car Benet-In-Kind Taxation Charges can

be found on www.citroen.co.uk/eet or by contacting

Citroën Fleet Connect on 08457 940 940.

COMPANY CAR BENEFIT-IN-KIND TAXATION CHARGES

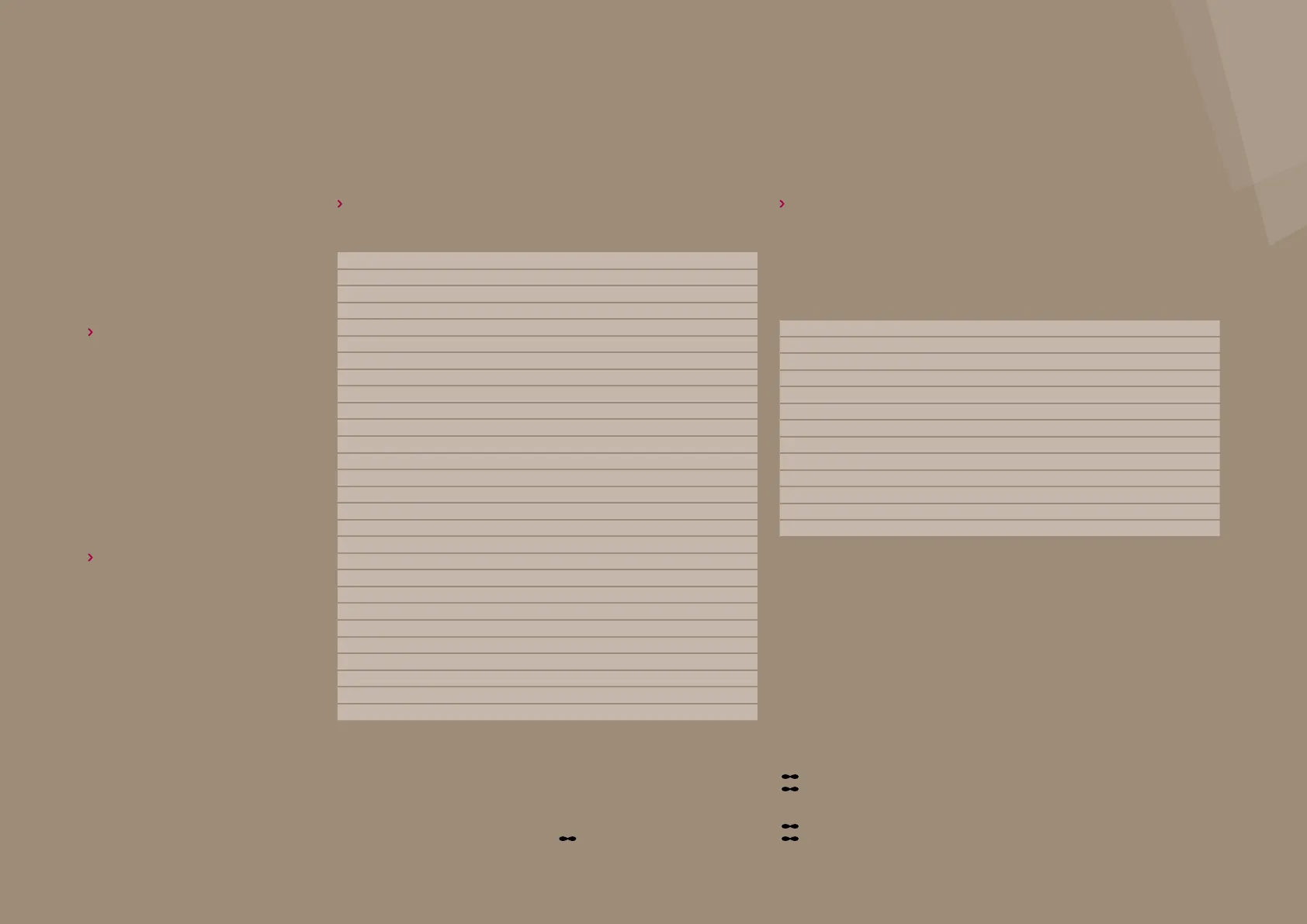

GRADUATED VEHICLE EXCISE DUTY (ROAD FUND LICENCE)

The Graduated V.E.D. bands classify all new cars rst registered from 1st March 2001 into one of

thirteen Vehicle Excise Duty bands, depending on their type of fuel and carbon dioxide (CO

2

) emissions

level, measured in grams per kilometre (g/km). There are two V.E.D. rates, a rate for the rst year and a

rate for subsequent years.

Cars with zero CO

2

emissions will be exempt from

company car tax for a 5 year period starting in 2010-11.

Special rules apply to cars with ultra-low emissions, a

reduced appropriate percentage of 5% applies, from

6 April 2010 for ve years, for company cars with an

approved CO

2

gure not exceeding 75g/km.

ˆ

Band K includes cars that have a CO

2

emissions

gure of over 225g/km but were registered before

23 March 2006.

†

The new Car’s price to be taxed includes:

Manufacturer’s Recommended Retail Price (inc V.A.T.)

Delivery to Dealer and Number Plates (inc V.A.T.)

The list price of an option or an accessory

(inc V.A.T. plus delivery and tting charges if

relevant). Some exceptions apply but excludes:

Graduated Vehicle Excise Duty

Government First Registration Fee

CO

2

emissions in grams per kilometre % of car’s price to be taxed

†

2014-15 tax year Petrol/Hybrid4 Diesel

1 to 75 5 8

76 to 94 11 14

95 to 99 12 15

100 to 104 13 16

105 to 109 14 17

110 to 114 15 18

115 to 119 16 19

120 to 124 17 20

125 to 129 18 21

130 to 134 19 22

135 to 139 20 23

140 to 144 21 24

145 to 149 22 25

150 to 154 23 26

155 to 159 24 27

160 to 164 25 28

165 to 169 26 29

170 to 174 27 30

175 to 179 28 31

180 to 184 29 32

185 to 189 30 33

190 to 194 31 34

195 to 199 32 35

200 to 204 33 35

205 to 209 34 35

210 to 214 35 35

Over 215 35 35

Band CO

2

g/km Petrol & Diesel cars

First year rate 2014/15 Standard rate 2014/15

A Up to 100 £0 £0

B 101 to 110 £0 £20

C 111 to 120 £0 £30

D 121 to 130 £0 £105

E 131 to 140 £130 £130

F 141 to 150 £145 £145

G 151 to 165 £180 £180

H 166 to 175 £290 £205

I 176 to 185 £345 £225

J 186 to 200 £485 £265

K

ˆ

201 to 225 £635 £285

L 226 to 255 £860 £485

M Over 255 £1,090 £500

PERFORMANCE WITH CARE FOR THE ENVIRONMENT